This article was produced by Stephan Soroka on Linkedin, original linkage is https://www.linkedin.com/pulse/food-delivery-apps-trends-statistics-2021-stephan-soroka-/

Foodtech has been the hottest topic in 2020 with the food delivery boom. 2021 is picking a new wave of crazy development of the on-demand delivery industry with the spread of grocery delivery growth!

@SensorTower conducted a report of the current state of food delivery apps in 2021.

Markets overview

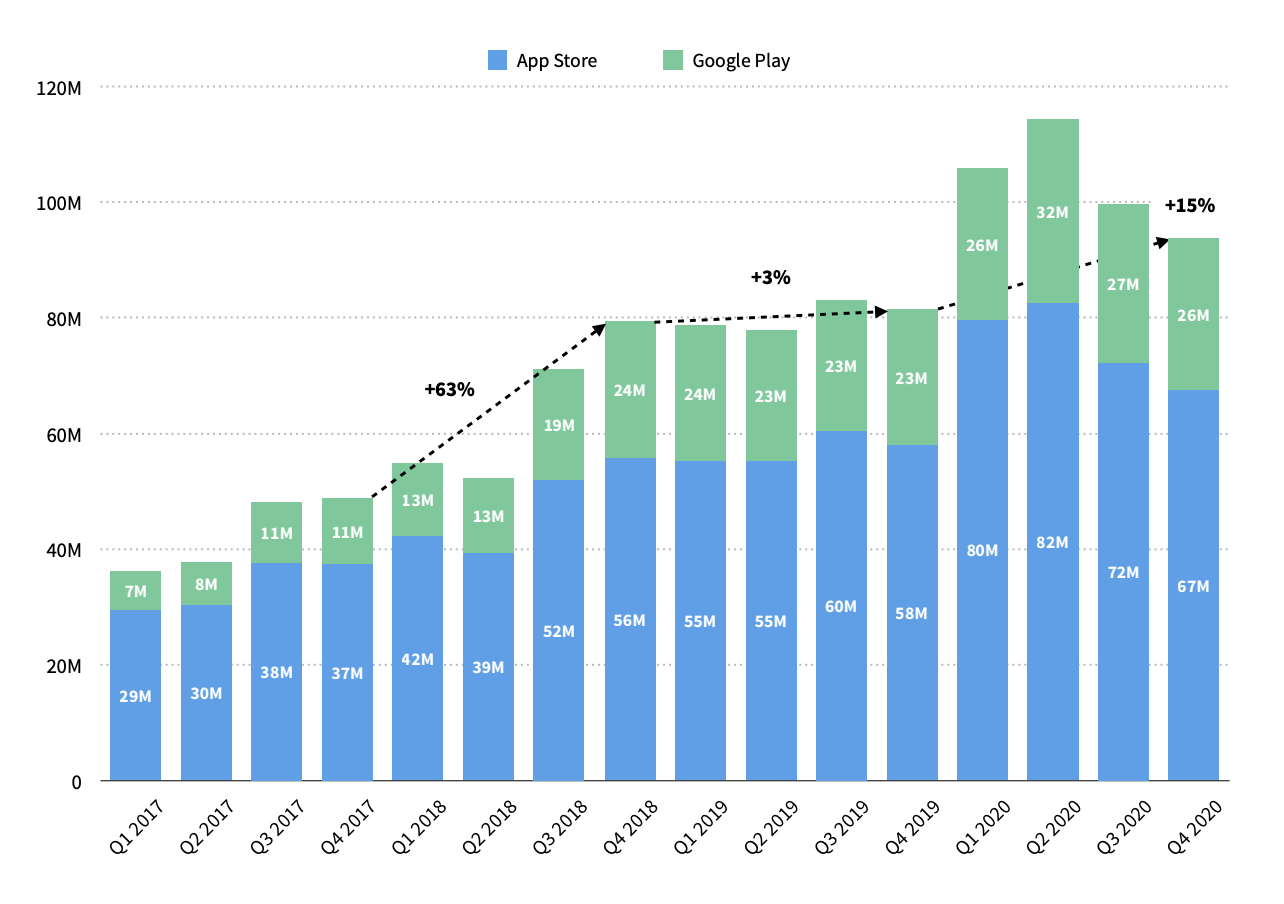

U.S. Adoption Soared 29 Percent Year-Over-Year (Quarterly U.S. downloads of food & drink apps on the App Store and Google Play)

U.S. food & drink app installs surpassed 400 million in 2020, with Q2 being the record quarter. Despite the slowdown in adoption growth, the Food & Drink category saw first-time installs of 64 million in the first two months of 2021, on track to meet the 105 million downloads from Q1 2020. The App Store drove the growth of food & drink app installs amid the outbreak of COVID-19, with 73 percent of adoption coming from the platform. DoorDash, Uber Eats, and McDonald’s were especially successful on both stores.

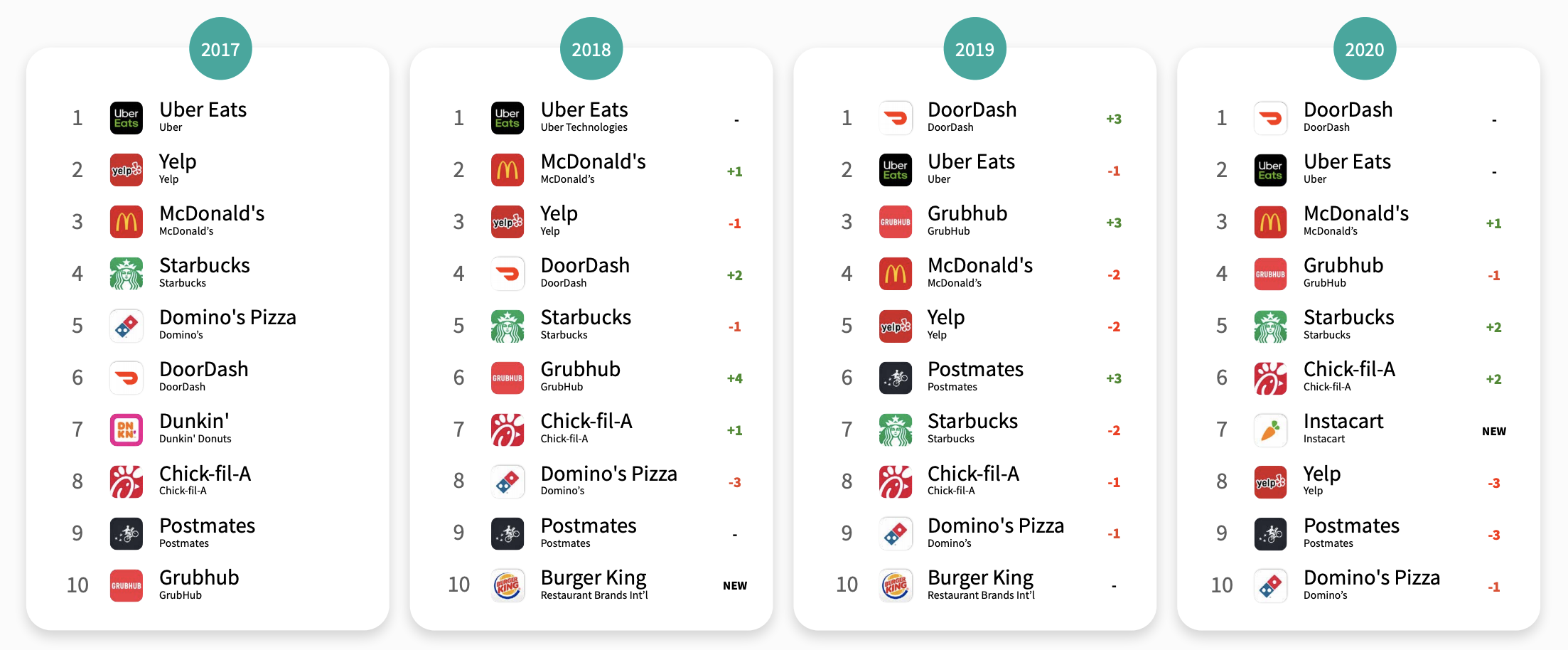

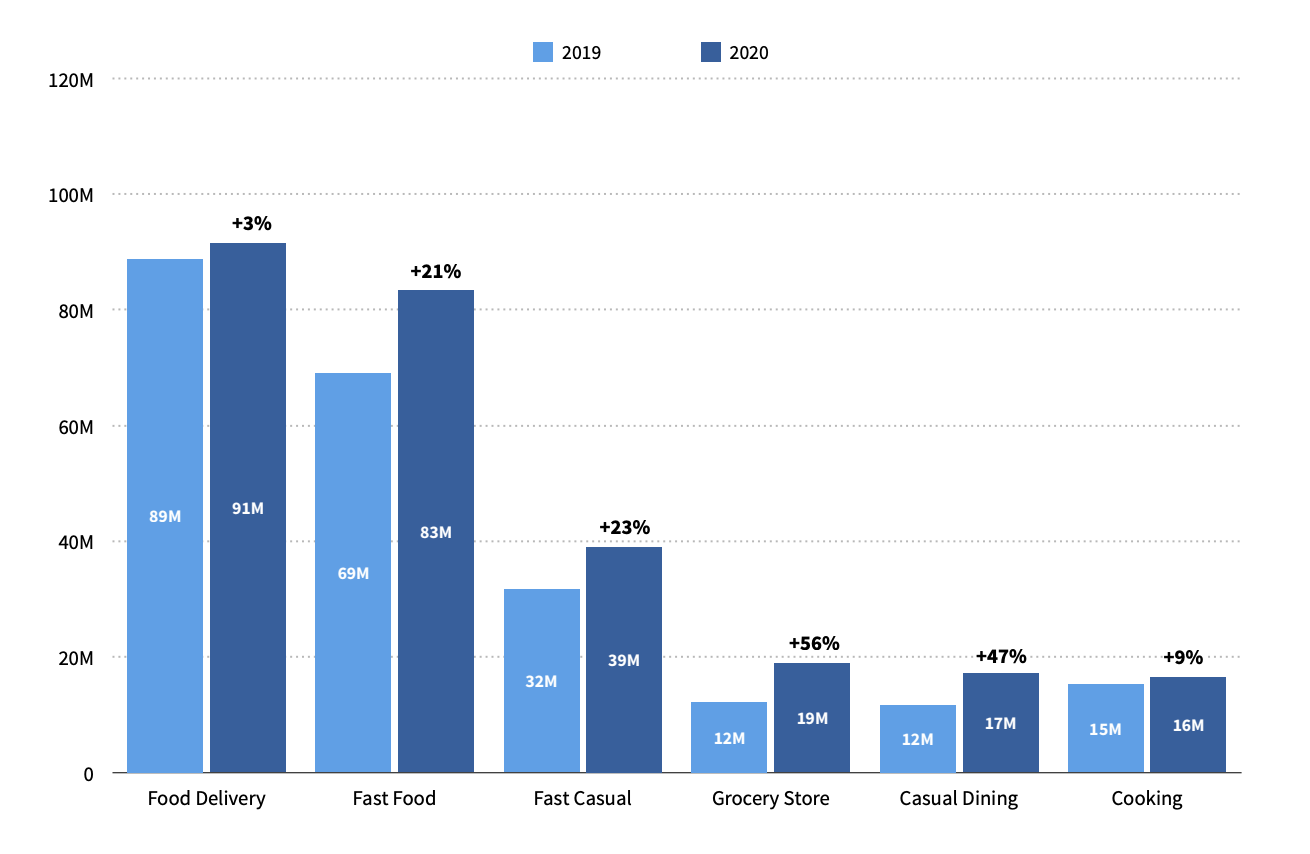

Fast Food Apps Climbed 21% Year-Over-Year Amid COVID-19 U.S. downloads among the top 10 food & drink apps by subcategory for 2019 and 2020

The top 10 Food Delivery apps accumulated 91 million U.S. downloads in 2020, seeing moderate growth of 3 percent year-overyear. Food Delivery apps had been performing exceptionally well even before COVID-19, positioning to reach record downloads during the outbreak. Fast Food, Fast Casual, and Grocery Store apps saw a major boost in adoption during the COVID-19. Many fast food apps saw lift in 2020, including non-delivery apps such as Subway and Taco Bell which saw Y/Y growth of 46 percent and 60 percent, respectively.

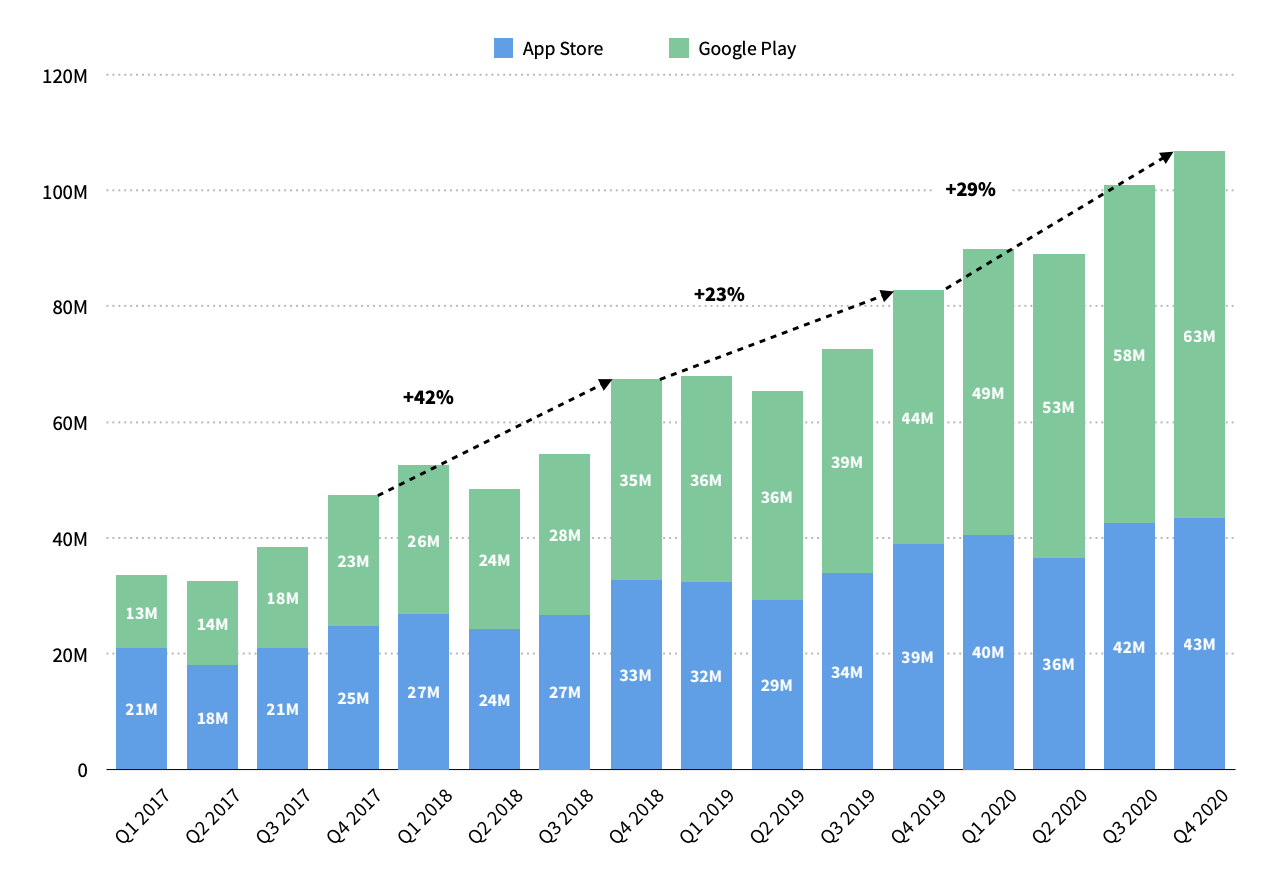

Food & Drink Saw Record Adoption in Europe During Q4 2020 Quarterly European downloads of food & drink apps on the App Store and Google Play

Food & Drink category installs surpassed 100 million in Q3 and Q4 2020, setting a new record each quarter and climbing at a year-over-year growth rate of 29 percent in Q4. This category has been on the rise in Europe and saw a total of 386 million downloads during 2020. Google Play contributed the vast majority of new installs for the category, accounting for 58 percent in 2020. In light of lockdown orders, Food & Drink is off to a strong start in 2021 in Europe, accumulating 74 million downloads in the first two months of the year and placing it 82 percent of the way to Q1 2020’s download total.

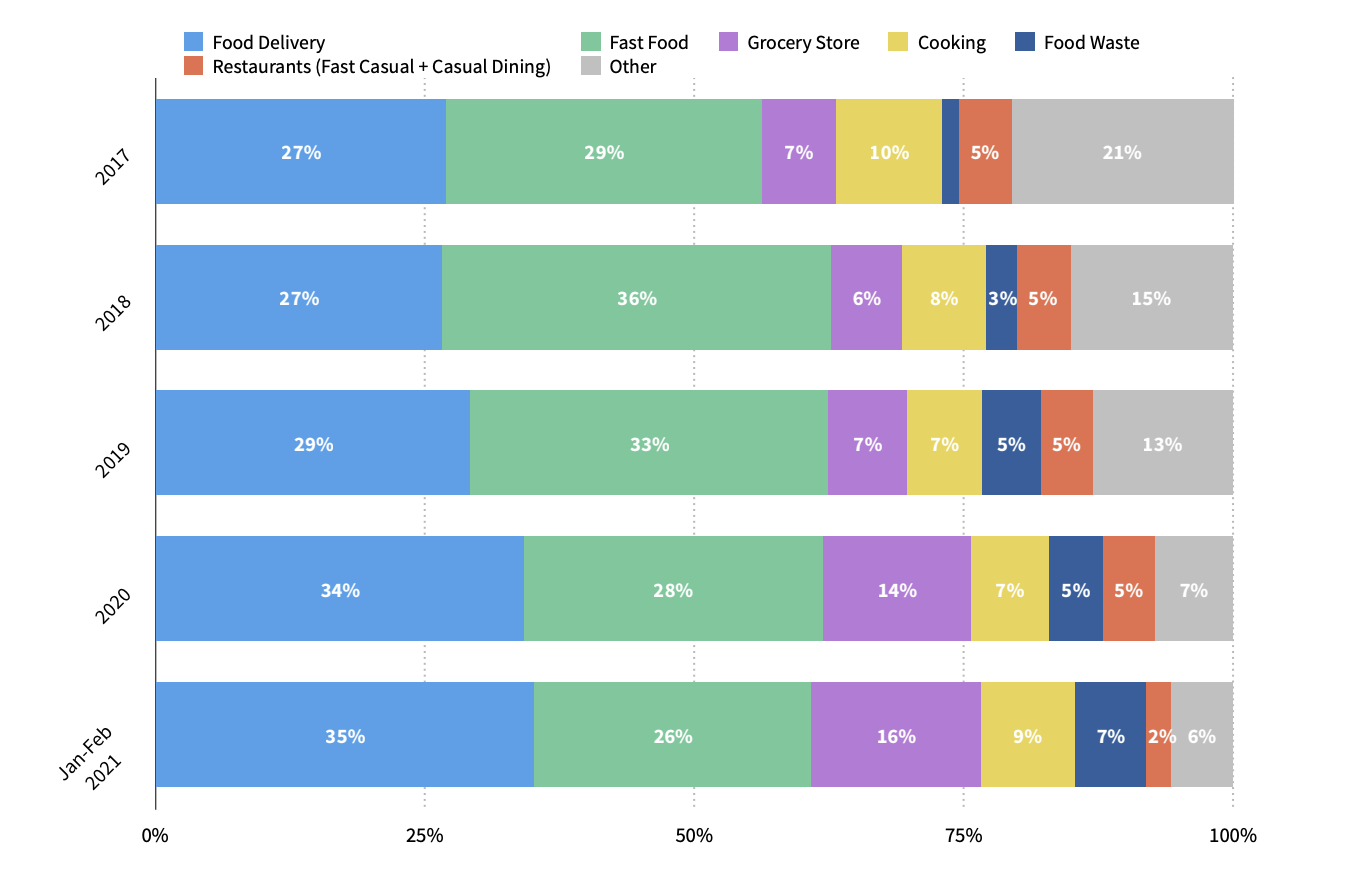

Food Delivery Reaches 35 Percent European Market Share (Proportion of European installs by subcategory among the top 100 food & drink apps)

Food Delivery apps accounted for 35 percent of European Food & Drink category downloads in the first two months of 2021. Uber Eats, Just Eat Takeaway, and Deliveroo were the top three Food Delivery apps in Europe during the first two months of 2021. Grocery Store apps have also been on a rise in Europe, accounting for a 16 percent share of the Food & Drink category in the beginning of 2021. Brick-and-mortar grocery store apps with delivery ranked among the top of the subcategory, such as Pyaterochka (based in Russia), REWE (Germany), and Morrisons (U.K.).

Food delivery U.S.

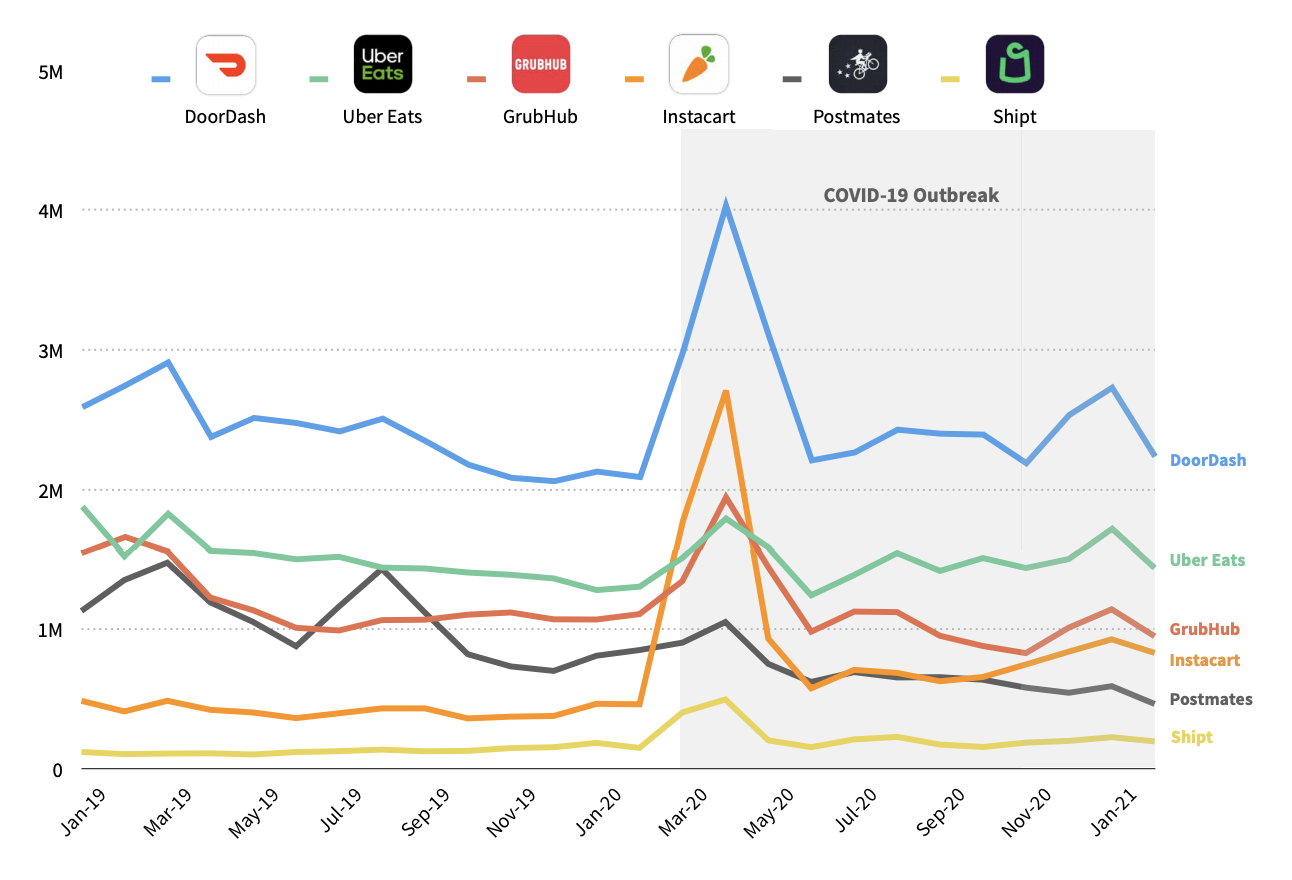

U.S. Food Delivery Downloads Spiked Again in January 2021 Monthly downloads of top food delivery apps in the U.S.

DoorDash saw its highest monthly downloads in April 2020, surpassing 4 million installs. January 2021 saw a spike in downloads with 22 percent year-over-year growth to surpass 3 million installs. Although Uber Eats didn’t see a large install spike in April 2020, the app saw steady downloads throughout the year. Uber Eats surpassed 1.4 million downloads in January 2021, accounting for 12 percent growth over the prior year.

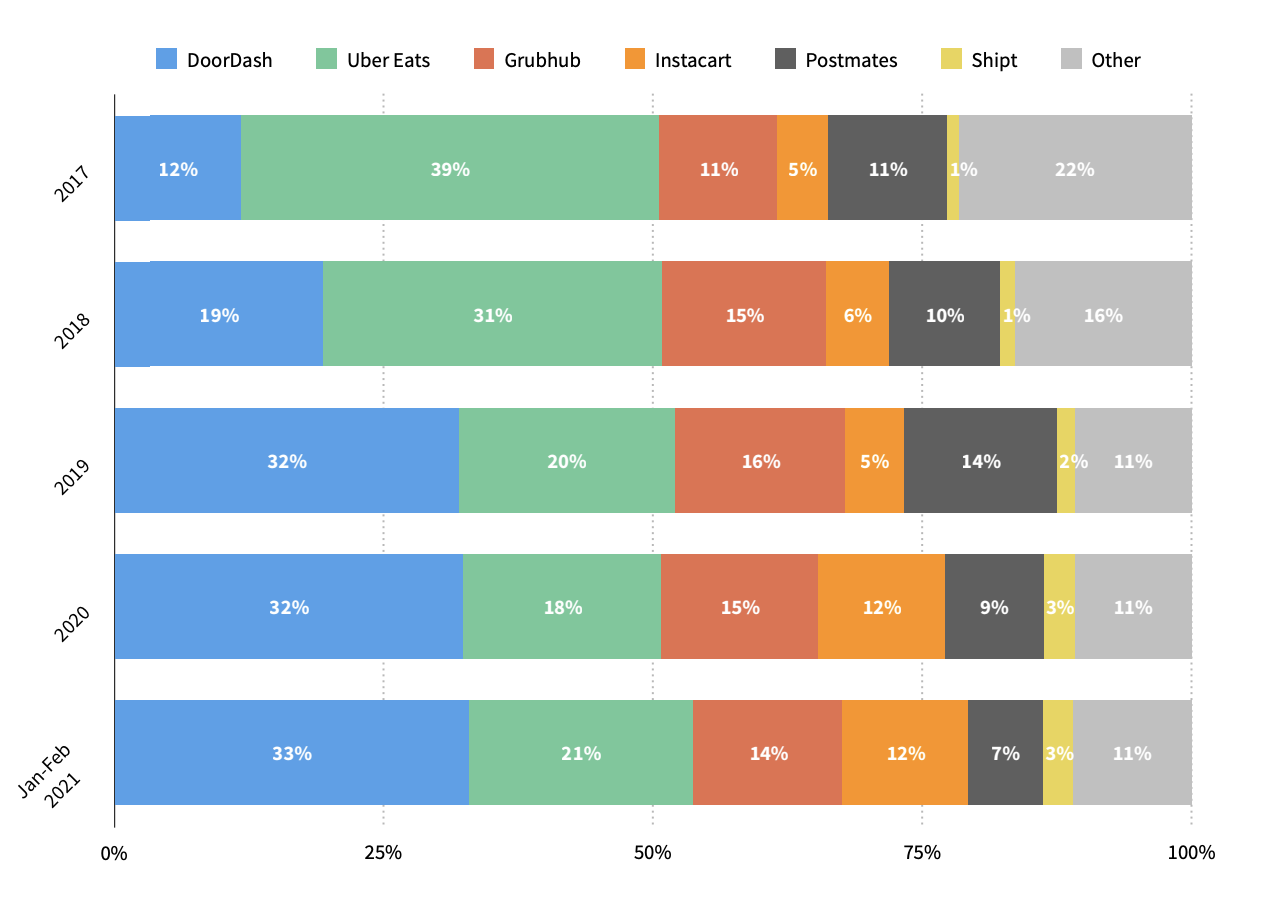

Instacart’s Increased Market Share Carried into the New Year Proportion of U.S. downloads among the top food delivery apps

DoorDash continued to lead the Food Delivery app space in the U.S. in the first two months of 2021, accounting for 33 percent of the market among the top apps. DoorDash’s share has remained above 30 percent since it surpassed Uber Eats to reach No. 1 in 2019. Instacart adoption surged during lockdown due to the high demand for grocery delivery, and it controlled 12 percent of the Food Delivery market in 2020. This success was not short-lived as Instacart’s share remained at 12 percent in the first two months of 2021.

Food delivery Europe

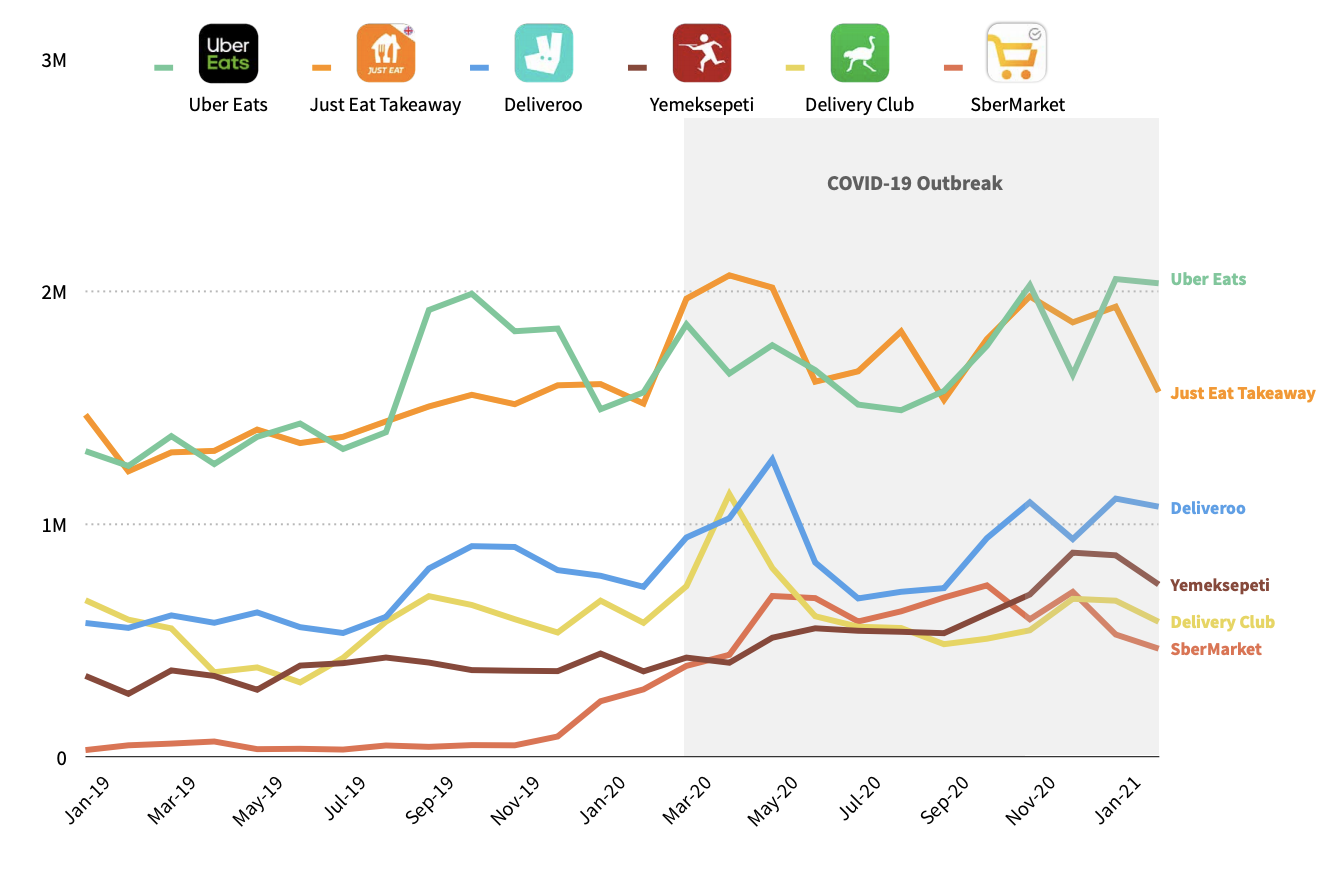

Top Food Delivery Titles are Trending Up in Europe Monthly downloads of top food delivery apps in Europe

Top European Food Delivery apps were able to retain the download growth seen during COVID-19 near the end of 2020 and the beginning of 2021. Uber Eats in particular surpassed 2 million downloads in January 2021, 10 percent higher than what it had seen in March 2020. Top apps are still climbing. Deliveroo surpassed 1 million downloads in the first month of the new year, clearly reaching its download record of 1.3 million in May 2020. Demand for food delivery continues to soar as British food delivery app Deliveroo recently listed its shares in London, preparing the firm for an IPO in April 2021.

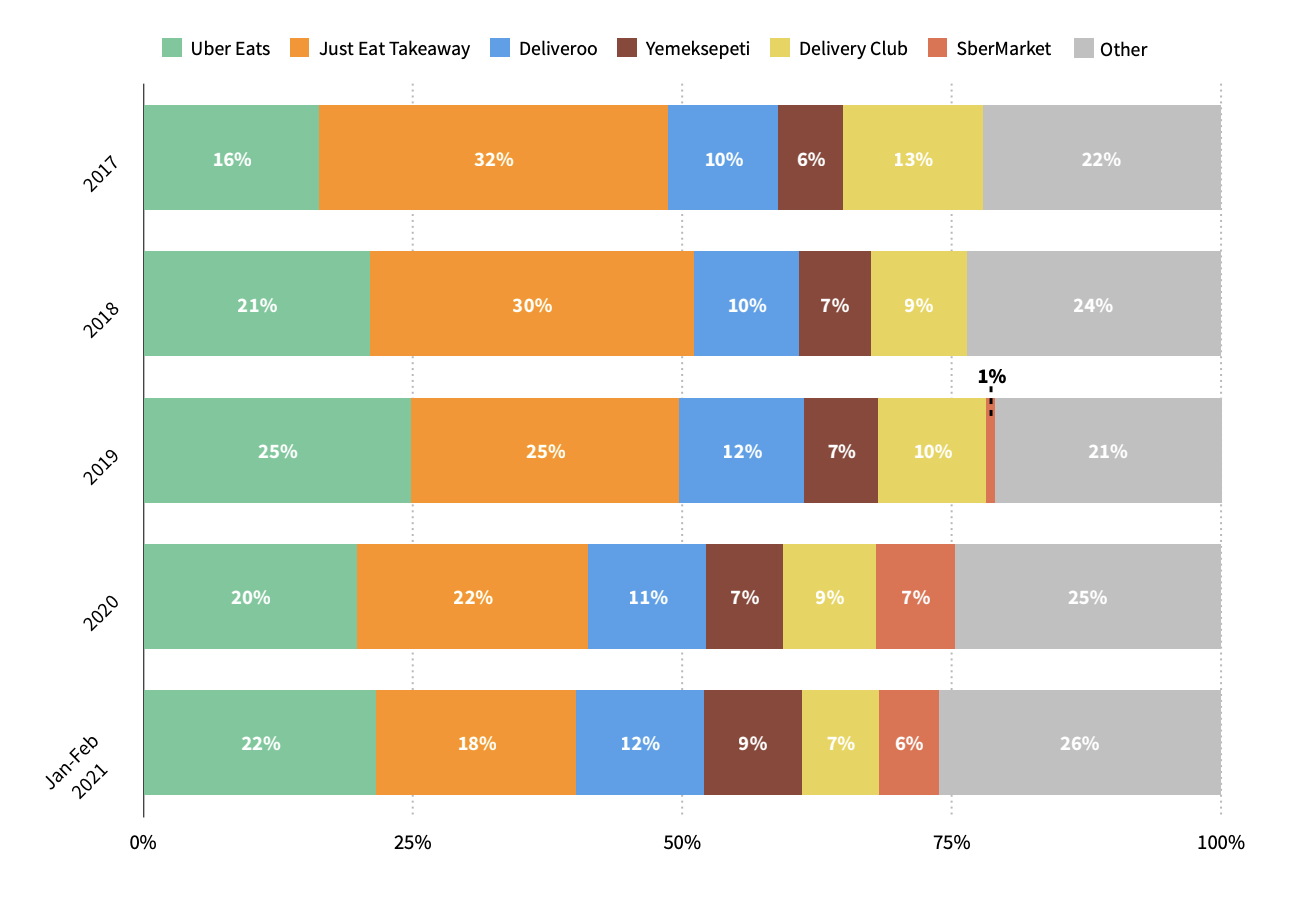

Uber Eats is in a Tight Race with Just Eat Takeaway Proportion of European downloads among the top food delivery apps

Uber Eats controlled the highest share of market in the first two months of 2021, accounting for 22 percent, while its biggest competitor, Just Eat Takeaway, accounted for 18 percent. The two apps have a major focus on the U.K. market, being the top two Food Delivery apps there, accumulating 5.5 million and 4.5 million downloads in the U.K. in 2020, respectively. As the third largest delivery service by downloads in Europe, Deliveroo sustained a stable market share within the competitive space. Deliveroo took 12 percent of the downloads among the top apps during the first two months of 2021.

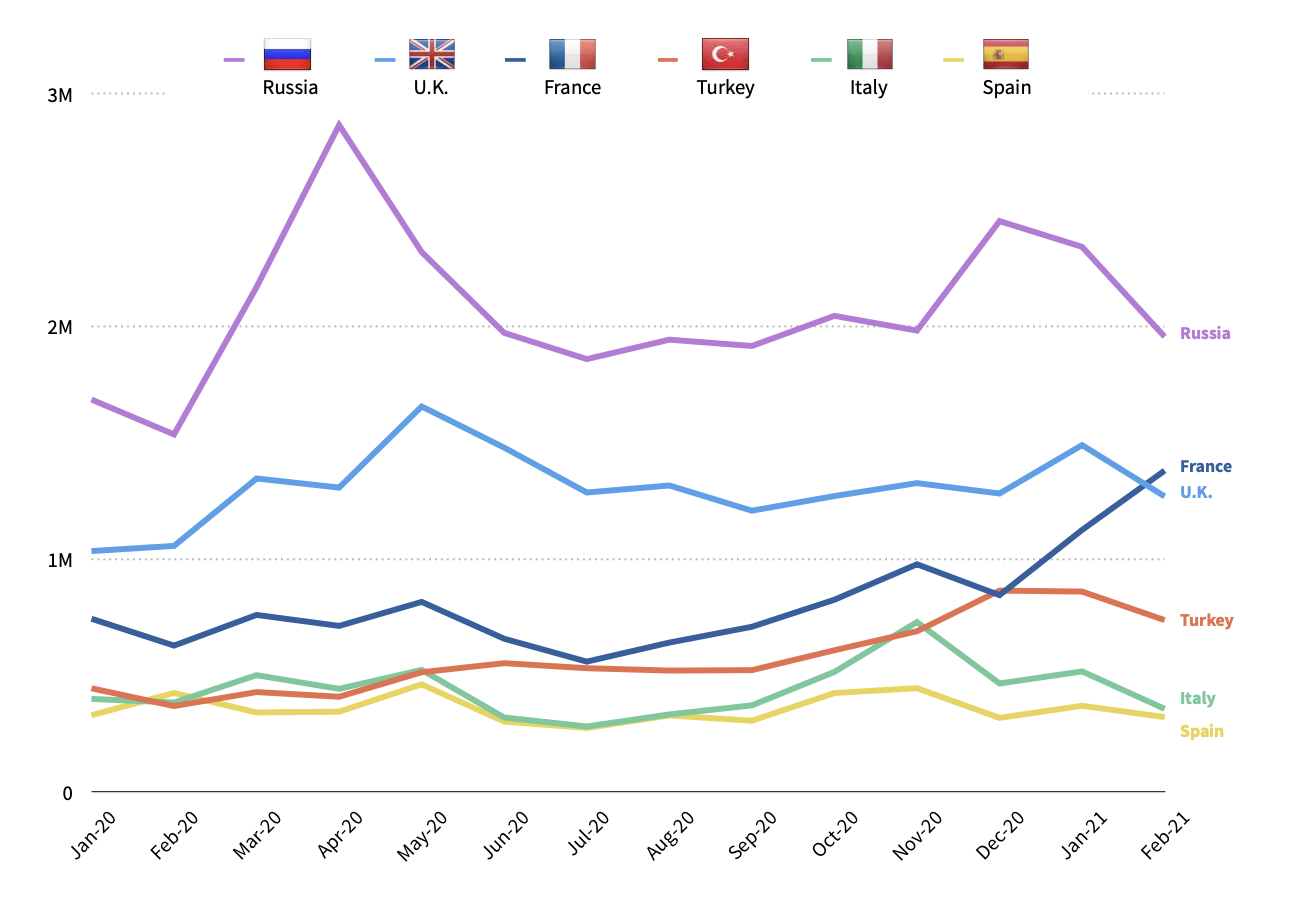

Food Delivery Apps are Soaring in France Monthly downloads for the top 20 food delivery apps in Europe by country

Food Delivery app downloads in Russia reached a record high in April 2020, when the top apps of this type combined for nearly 2.9 million downloads. Although it will be difficult to reach this level again, Russian Food Delivery downloads grew to 2.5 million in December 2020 after hovering around 2 million for the second half of 2020. The U.K. market saw consistency in downloads, signaling a stable demand for food delivery, while France growth surged. Food Delivery apps surpassed 1 million downloads in January 2021 in France, 51 percent growth over January 2020.

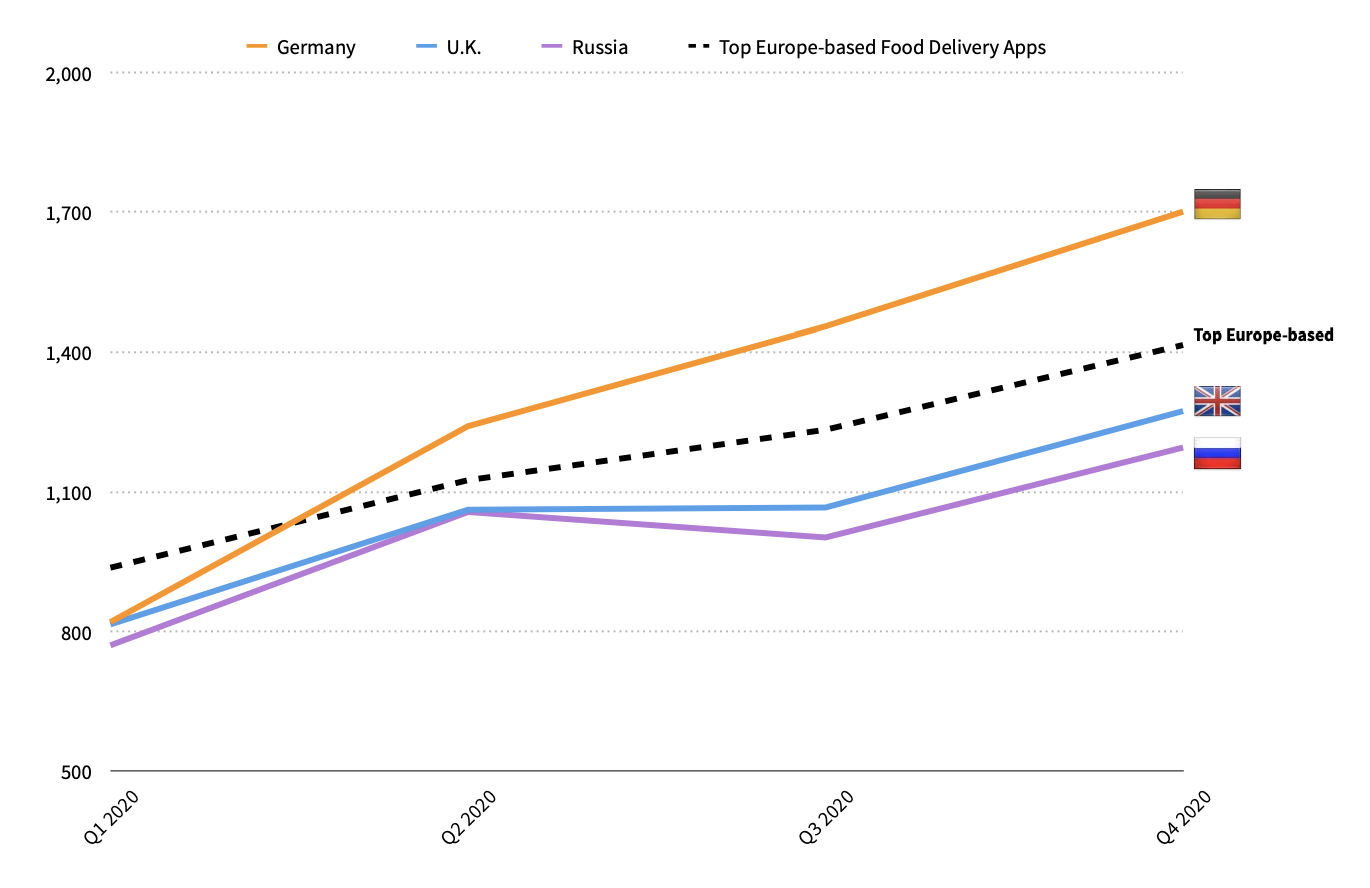

European Food Delivery Apps Climb in Monthly Time Spent Monthly average seconds spent in top Google Play food delivery apps by publisher country

European-published Food Delivery apps soared 51 percent in average monthly time spent per user on Google Play at the end of Q4 2020, compared to Q1 2020. The top food delivery apps from European publishers surpassed 23 minutes in average monthly time spent per user in Q4 2020. Germany-based delivery apps such as Lieferando, Foodpanda, and Foodora were among the standouts in terms of user time spent on Google Play in 2020, reaching an average of 28 minutes per month per user in Q4 2020.

As a conclusion from me personally, want to outline once again that it is all just the beginning of the race! The new industry is changing our lives here and now!

This article was produced by Stephan Soroka on Linkedin, original linkage https://www.linkedin.com/pulse/food-delivery-apps-trends-statistics-2021-stephan-soroka-/

Food Delivery Apps trends and statistics 2021 Related Video:

, , ,